Crafting an Effective and Competitive 401(k)

Balance cost and competitiveness without compromise.

In today’s competitive business landscape, your 401(k) plan can be more than just another line item on an expense report—it can be a key to unlocking higher employee satisfaction and retention.

That said, optimizing your retirement plan doesn’t require a choice between cost savings and competitive benefits. With the right strategies, you can elevate your 401(k) plan from a financial obligation to a powerful tool for fostering a motivated, loyal workforce. Here are ways to help achieve a balanced, effective 401(k) design that benefits both your employees and your bottom line.

Plan design that pays

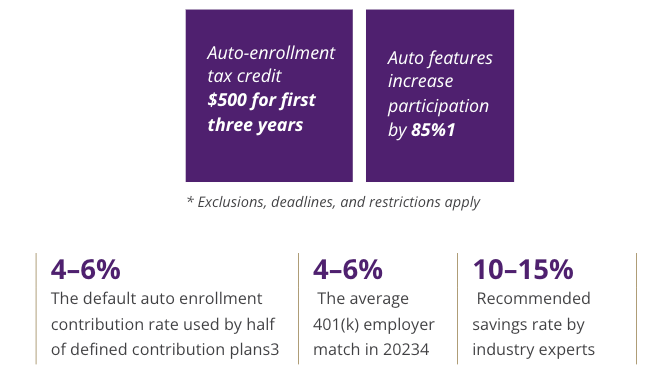

To offer a competitive retirement benefit that boosts retention and incentivizes employees to save for retirement, have you considered auto-enrollment and auto-escalation?

Auto enrollment and auto escalation lower the barriers to saving, increasing participation by 85% (auto-enrollment) and potentially boosting savings rates by at least 1% of salary per year until a 10-15% cap is reached (auto-escalation). Also, beginning January 1, 2025, all new plans will be required to include auto-enrollment and auto-escalation.*

If your plan doesn’t offer auto-enrollment, there is an employer tax credit of $500 for the first three years. Increasing the initial default deferral rate can also help improve readiness and encourage on-time retirements.

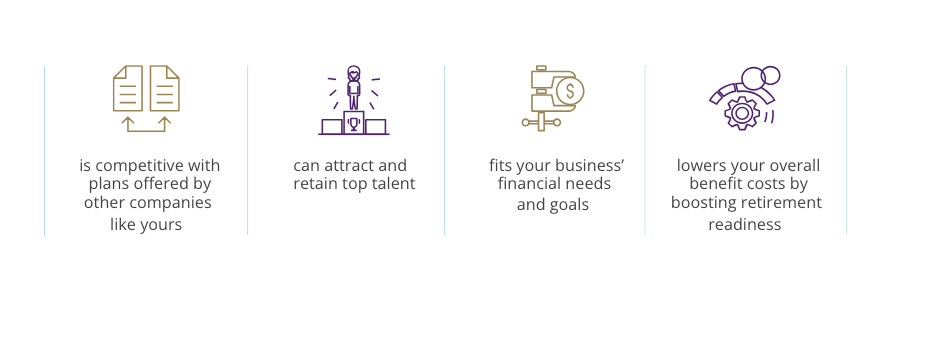

Benchmarking may help to reduce plan fees

Benchmarking—regularly comparing your retirement plan to your industry peers—is more than your fiduciary responsibility. It’s an essential best practice to ensure that your plan fees are competitive and in line with industry standards. Benchmarking is the process of evaluating plan fees, investment options and costs, and service providers toward ensuring your 401(k) plan:

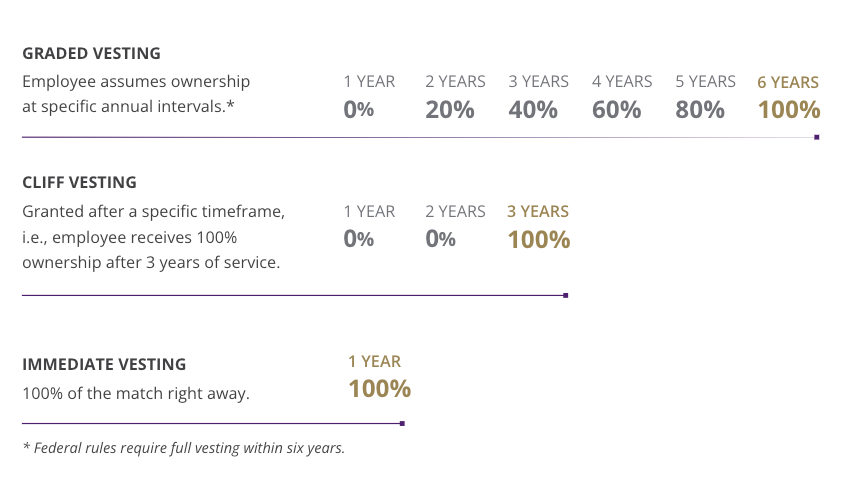

Vesting schedules encourage retention, help with cash flow

If you offer a company match, the vesting schedule can encourage employee retention and help you manage long-term cash flow more effectively. If an employee leaves or is terminated before becoming 100% vested, the plan retains the unvested portion, and those dollars can be used to offset future employer contributions and/or be used to pay for plan expenses.

Vesting schedules vary—here are the most common:

Employer contributions: consider the alternatives

An employer match is only one type of incentive contribution. Instead, you might choose to grant company equity or offer profit sharing. These alternative strategies enable you to incentivize employees while providing flexibility to vary contributions from year to year based on business performance and economic conditions.

Embracing effective strategies

Crafting an effective plan design strategy can help you streamline costs while providing a competitive retirement benefit. Now may be a good time to review your current 401(k) plan with a focus on flexibility and cost-efficiency.

CONTACT US to discuss tailored plan design strategies that reflect the unique needs of your business and employees.